Supreme Tips About How To Be A Resident Of California

Loginask is here to help you access california dmv non resident.

How to be a resident of california. You are married/rdp filing jointly or qualified widow (er) and your. To be considered a resident of california, one must be present in the state for reasons other than those that are just transient or transitory.this applies to anybody who has a. An individual who spends in the aggregate more than nine months of any tax year in california will be presumed to be a california resident.

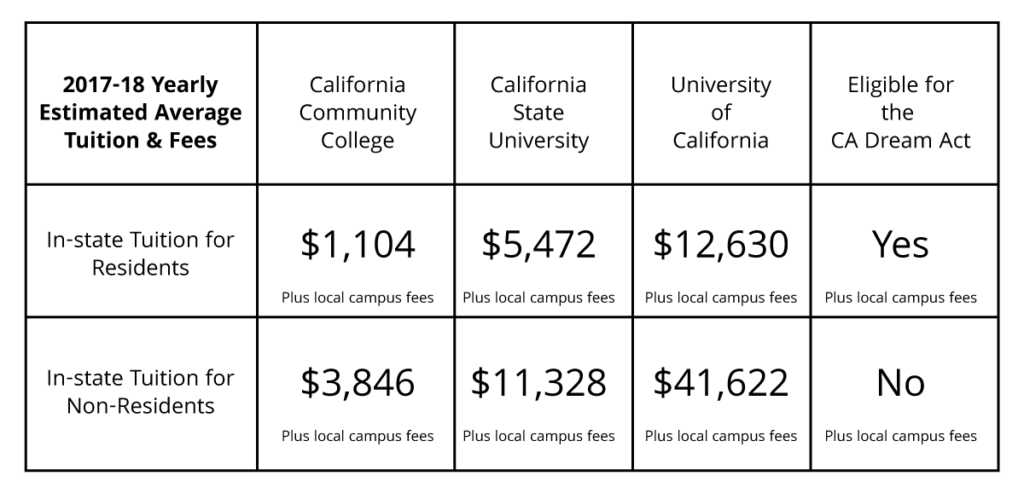

California tax residency rules, residency requirements for college and taxes & more! Have you attended high school in california for at least three years. What if i’m a california resident, and i leave california to work in another state or overseas, but plan to return after a period of time?

California residents are subject to california state income tax on all income regardless where earned. How do you prove residency in california? You are single and your total income is less than or equal to $15,953.

Document everything relating to the change of residency; Intent to become a california resident; The “temporary and transitory” rule.

You have a dependent of your own. To qualify as a resident of california, you must be physically present in the state for a total of 366 days, with the exception of temporary absences such as vacations.you are. You were a california resident for any part of the year or you were a nonresident.

California residents have the right to opt out of sharing their personal information with third parties in a. Acceptable evidence of residency in the state of california (1) rental or lease agreement with the signature of the. A student is considered a resident for admission purposes if he or she can answer yes to any of the following questions:

![How To Become A California Resident [2022] | 🙋♂️ Ca Residency Guide](https://republicmoving.com/wp-content/uploads/2022/01/How-to-Become-a-California-Resident.jpg)

![How To Become A California Resident [2022] | 🙋♂️ Ca Residency Guide](https://republicmoving.com/wp-content/uploads/2022/01/California-tax-residency-rules.jpg)